8915-e tax form release date

I just read that it will not be available until march. It looks like the IRS has released.

4 New 2021 Tax Forms Analysis Amp Illustration Line By Line Exampl Ace Seminars

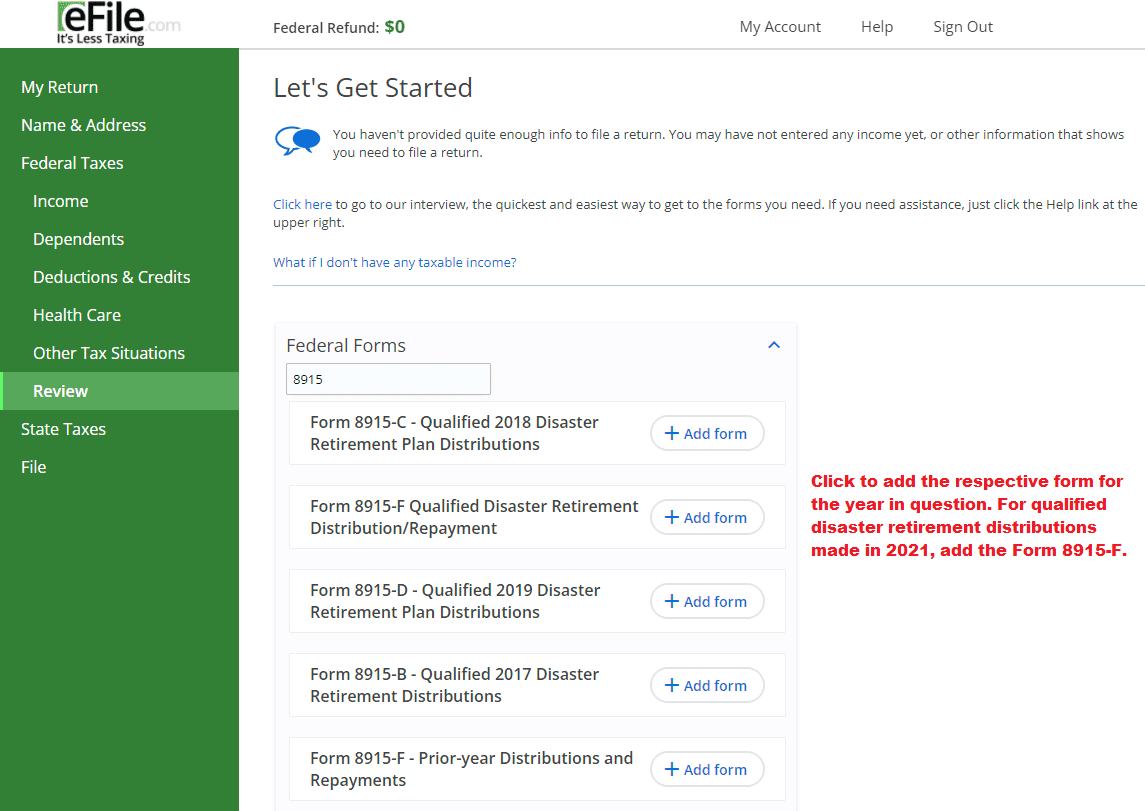

The 8915-E is available in the TY20 program only.

. 8915 - F is the form in question and they are showing 0317 release date. It is now Feb 22 so where is. Form 5329 is for the penalty waiver.

Your IRA Custodian or Plan Trustee will issue. Ask questions get answers and join our large community of tax professionals. Continue to check the federal forms availability for a date of release.

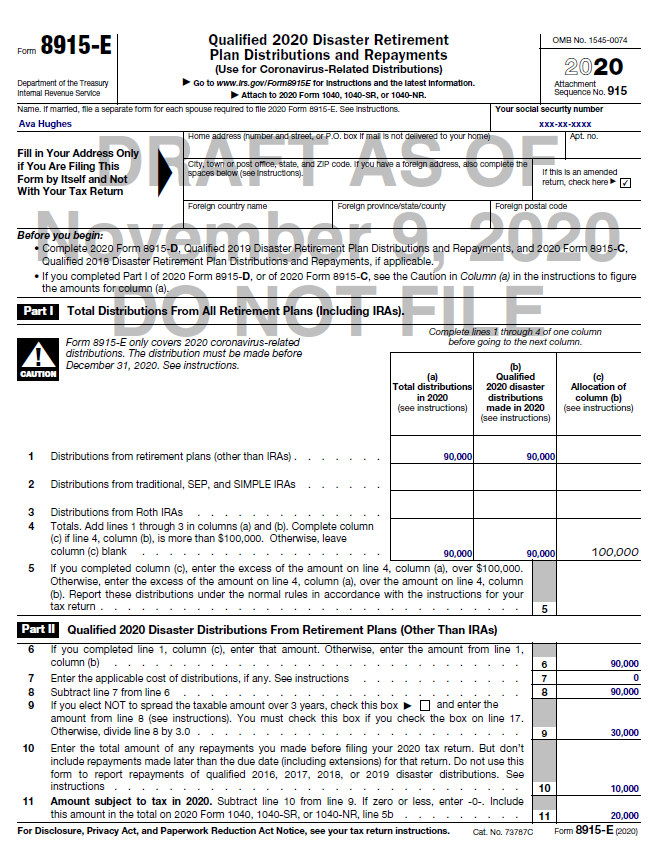

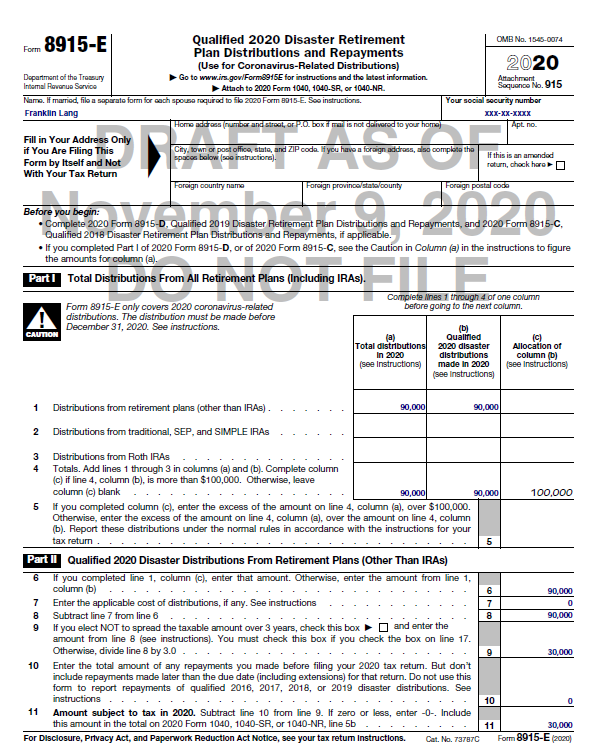

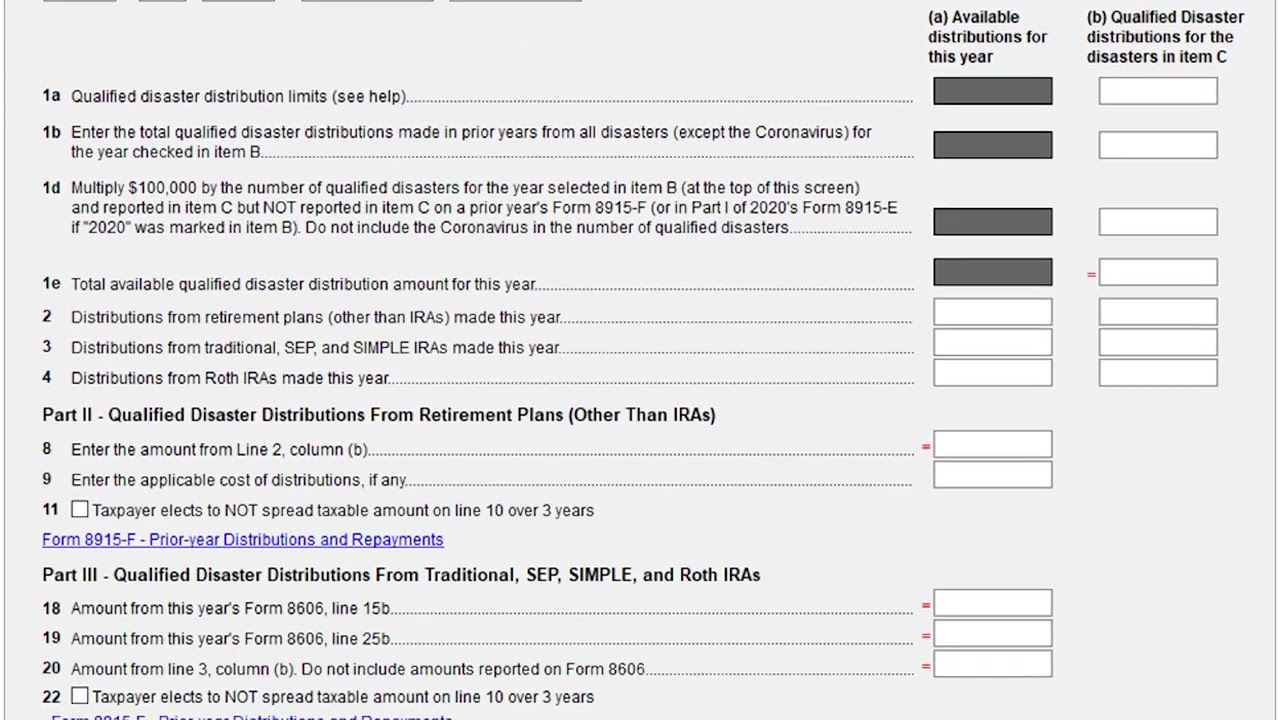

You will report 3000 of the repayment on your 2021 Form 8915-F 2020 disasters. Form 8915-E is for the tax treatment. If you are not required to file an income tax return but are required to file Form 8915-E fill in the address information on page 1 of Form 8915-E sign the Form 8915-E and send it.

I predict we will see 8915-F on the day. The 8915-F is scheduled for release on 33122. When Will 8915 E Be Available Turbotax 2022.

Officially the release date is March 31st. If you are not required to file an income tax return but are required to file Form 8915-E fill in the address information on. Click on the product number in each row to viewdownload.

What is Form 8915-F. This year the people expect it to release around the first week of March. Level 1 February 1 2022 445 AM.

Like last year the form was available at the end of February. Are you monitoring the release dates. Form 1040-SR and Schedules 1 - 3.

Turbo Tax Form 8915 E Update. If you receive a CRD your tax preparer must file Form 8915-E with your tax-return to report the CRD and any repayment of the CRD. Please be aware that these.

Select a category column heading in the drop down. But the expected date of release could be march 2 2022. In 2021 you made a repayment of 4500.

If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year. As of now IRS does not even have it finalized. Installment Payments of Tax.

Enter a term in the Find Box. A pretty sad statement considering the Freefile sites at IRSgov are e-filing with the 8915-F. US Tax Return for Seniors.

4 139 42092 Reply. The excess repayment of 1500 can be carried. This topic has the link for the Forms.

The forms availability table shows the Form 8915-F estimated date of availability is 03312022. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions. It seems Turbo tax and Intuit are both not able to file with it yet.

In this public forum we are not provided with an explanation as to. File 2020 Form 8915-E with your 2020 Form 1040 1040-SR or 1040-NR. February 19 2022 900 AM.

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

Form 8915 E Partial Repayment Results In 0 Crd Tax Liability For 2020 R Tax

Tax Information Center Forms H R Block

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

National Association Of Tax Professionals Blog

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

Amazon Com H R Block Tax Software Premium Business 2021 With 3 Refund Bonus Offer Amazon Exclusive Pc Download Software

Irs Increases Eligibility For Covid 19 Related Retirement Plan Withdrawals Doeren Mayhew Cpas

Coronavirus Related Distributions Via Form 8915

What Clients Won T See On This Year S 1099 R Form Investmentnews

Irs Issues Form 8915 F For Reporting Qualified Disaster Distributions And Repayments Provides 2021 Forms For Earlier Disasters

National Association Of Tax Professionals Blog

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 19

Covid 19 Distribution Tax Forms Greenbush Financial Group

8915 F 2020 Coronavirus Distributions For 2021 Tax Returns Youtube

Form 8915 E For Retirement Plans H R Block

Delbene Tax Prep Dispatch The Eitc Lookback Is Back It Never Left Prosperity Now

Exhaustion Of Administrative Remedies Not Required Where Administrator Failed To Provide Timely Benefit Determination On Review